BlackRock plans crypto ETF that tracks firms with exposure to metaverse

« Return to News

The worlds largest exchange-traded fund issuer is taking another step into cryptocurrencies with the filing of a new metaverse product, just months after launching a digital-assets fund that has so far failed to interest investors.

BlackRock Inc. is aiming to track companies that have exposure to the metaverse via the iShares Future Metaverse Tech and Communications ETF, according to a Thursday filing. The fund, for which fees and a ticker werent yet listed, might include firms that have products or services tied to virtual platforms, social media, gaming, digital assets, augmented reality and more.

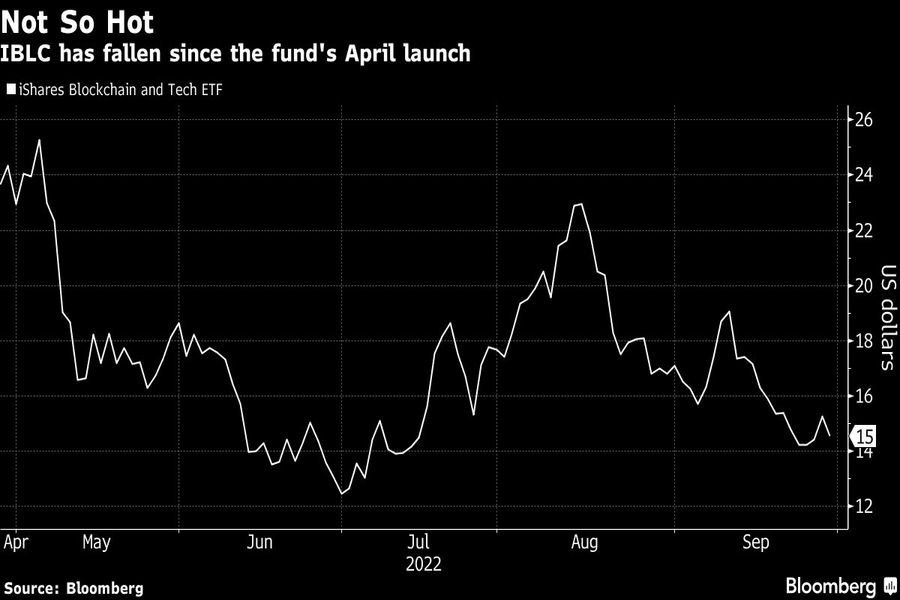

The parent company is making inroads into digital assets, launching in April its blockchain and tech fund (IBLC), which has inflows totaling about $6 million. BlackRock recently partnered with crypto exchange Coinbase Global Inc. to make it easier for institutional investors to manage and trade Bitcoin, making waves in the crypto market.

Yet interest in the digital-assets ecosystem has plunged this year as prices for just about every crypto token have tanked. Bitcoin, the largest by market value, has plummeted about 60% in 2022 and Ether has declined as well. Google searches for cryptocurrencies have also diminished amid the so-called crypto winter.

You can tell from other metaverse, blockchain funds that interest has waned, said Todd Sohn, ETF strategist at Strategas Securities. I get the long-term idea, but now theres a ton of competition in the space too.

BlackRocks metaverse ETF wouldnt be the first. A handful of funds are already trading, including the Roundhill Ball Metaverse ETF, and there are also products from Subversive and Fidelity.

‘IN the Nasdaq’ with Jack Janasiewicz, lead portfolio strategist at Natixis

Have any Questions?

We're here to help. Send us an email or call us at +1 (585) 329-9661. Please feel free to contact our experts.

A donation will be made by Adviser First Partners to a Veterans organization on behalf of all financial professionals and firms that register each month

Contact Us© 2025 Adviser First Partners. All Rights Reserved.

Web Design by eLink Design, Inc., a Kentucky Web Design company