Volatility gauges flash warning for stock rally

« Return to News

Fear gauges for the S&P 500 and Nasdaq 100 indexes may be providing reasons for caution about the rally in U.S. stocks.

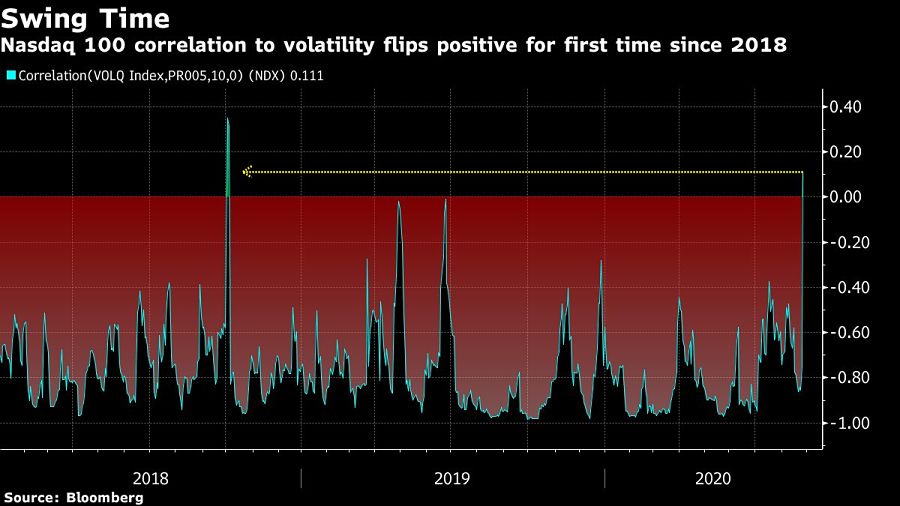

The S&P 500 and Nasdaq 100 scaled new peaks Wednesday, but their respective measures of implied volatility also rose in tandem. Simultaneous increases in equity and volatility gauges are unusual, and a reason for concern for some. The pattern was repeated for the S&P 500 on Thursday.

Wednesday was the first time in about two decades that the Cboe Volatility Index — or VIX — rose more than 5% as the S&P 500 rose over 1% to a record, Jason Goepfert, president of Sundial Capital Research Inc., wrote in a note. History suggests stocks tend to decline a median 1.2% in the following month when that happens, he added.

This might be the weirdest market Ive ever seen, Goepfert said, adding hes seen market oddities for weeks, and so far they havent mattered.

Thats underscored by a surge in U.S. stocks that defied convention and skeptics alike. The Nasdaq 100 has rebounded 71% from the virus-induced lows in March, and the S&P 500 is up 56%. The rally has stretched valuations and faces risks from stalled U.S. fiscal stimulus talks. But investors are taking comfort from the Federal Reserves plan to retain accommodative monetary policy and shift to a more relaxed approach on inflation.

Wednesdays session also saw a 2.1% rise in the Nasdaq 100 Index, accompanied by a more than 10% increase in the Cboe NDX Volatility Index. Both have climbed in August, but the move in the volatility measure may be due to investors chasing the stock rally, according to Susquehanna Financial Group.

We are seeing more upside panic in the Nasdaq, Chris Murphy, a derivatives strategist at Susquehanna, wrote in a note.

A range of uncertainties are set to be resolved in the months ahead, such as those related to stimulus spending, Novembers presidential election and the possible introduction of a COVID-19 vaccine.

Thats going to bring VIX down to about 16, from about 24 currently, said Michael Kelly, head of multi-asset at PineBridge Investments. Its extraordinarily unusual for the VIX to stay above 20 for an extended period of time without a crisis situation going on, he said.

[More: Money managers see threats to record stock rally]

The post Volatility gauges flash warning for stock rally appeared first on InvestmentNews.

Have any Questions?

We're here to help. Send us an email or call us at +1 (585) 329-9661. Please feel free to contact our experts.

A donation will be made by Adviser First Partners to a Veterans organization on behalf of all financial professionals and firms that register each month

Contact Us© 2025 Adviser First Partners. All Rights Reserved.

Web Design by eLink Design, Inc., a Kentucky Web Design company