Fidelity offers first Bitcoin fund

« Return to News

Fidelity Investments is launching its first Bitcoin fund, adding its establishment name and star power to the fledgling and often controversial asset class.

The money manager said in a filing to the Securities and Exchange Commission that it will begin to offer the Wise Origin Bitcoin Index Fund I through a new business unit called Fidelity Digital Funds. Peter Jubber, head of Fidelity Consulting, will run the new business unit,the filing shows.

The passively managed, Bitcoin-only fund will be made available to qualified purchasers through family offices, registered investment advisers and other institutions, according to a person familiar with the matter. Fidelity Digital Assets will custody the fund, the person said. The minimum investment is $100,000.

A spokeswoman for Fidelity declined to comment on the filing.

Fidelity has made a long-term commitment to the future of blockchain technology and to making digitally native assets, such as Bitcoin, more accessible to investors, the company said in an email.

Fidelity Chief Executive Abigail Johnson isamongthe highest-profile Wall Street proponents of the blockchain technology that backs Bitcoin, and the firm has dabbled in the space since 2014. Two years ago, itstartedFidelity Digital Assets, a unit meant to manage these products for hedge funds, family offices and trading firms.

Fidelitys latest foray into the world of crypto is welcome news for fans who have long sought greater acceptance of digital currencies and blockchain by Wall Street mainstays. Banks have largely avoided the sector because of concern about its use in money laundering and other illicit activities.

Few other mainstream firms have ventured into the crypto-sphere though there are signs interest in crypto products could be increasing. Cryptocurrency trusts by Grayscale Investments, for instance,attractedmore than $900 million in the second quarter, nearly double the previous quarterly high. The money came mostly from institutional investors and brought its total assets under management to over $4 billion.

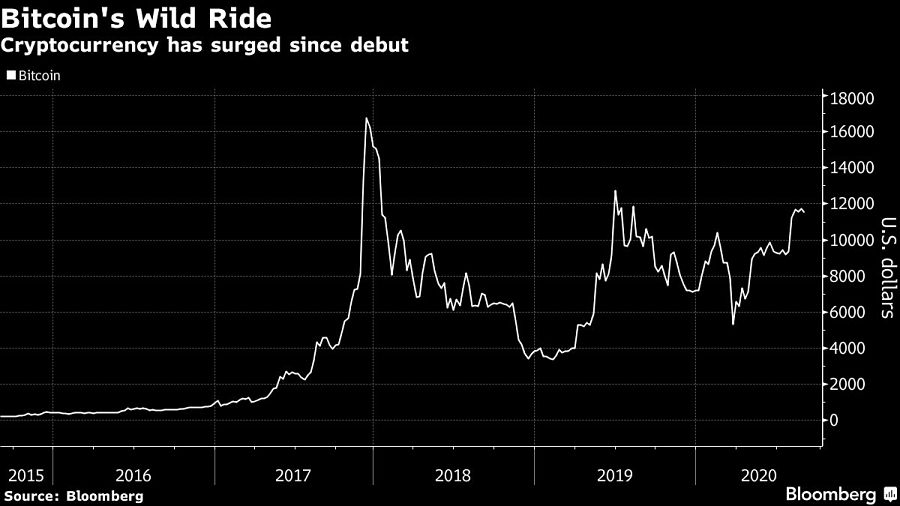

Fidelitys move comes at a time when the price of Bitcoin, the worlds largest cryptocurrency, has recouped much of its losses since crashing in March in the midst of a coronavirus-induced sell-off. Bitcoin is up roughly 60% this year to trade around $11,500 — though its still about 40% off its all-time high reached in 2017.

[More: Is Bitcoin a safe bet during market sell-offs?]

The post Fidelity offers first Bitcoin fund appeared first on InvestmentNews.

Have any Questions?

We're here to help. Send us an email or call us at +1 (585) 329-9661. Please feel free to contact our experts.

A donation will be made by Adviser First Partners to a Veterans organization on behalf of all financial professionals and firms that register each month

Contact Us© 2025 Adviser First Partners. All Rights Reserved.

Web Design by eLink Design, Inc., a Kentucky Web Design company